Business Profile of the Vishal Mega Mart Limited

Vishal Mega Mart is a leading offline-first diversified retailer in India, catering to middle and lower-middle income consumers. The company offers a diverse range of products across apparel, daily use products, utensils and FMCG product. They target their consumers on variety, affordability, quality, and convenience. The apparel category includes products for all family members, while the general merchandise category includes home appliances, crockery, and utensils. The company’s in-house design team ensures quality by closely monitoring manufacturing and quality control processes.

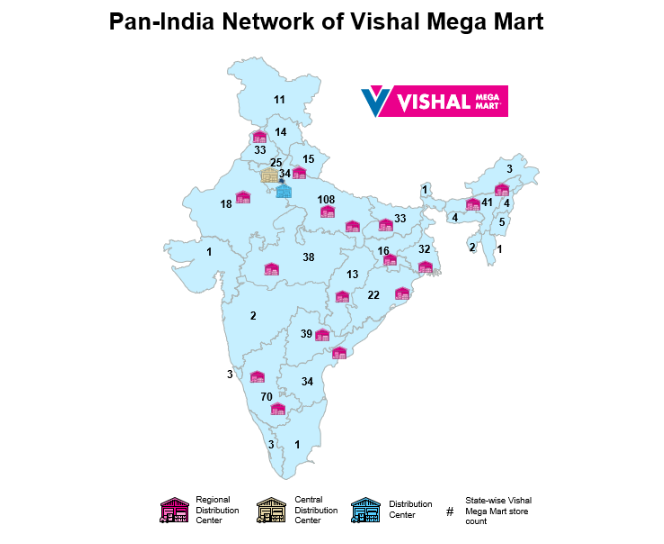

The company operated on pan India level with a network of 626 stores. The company has an asset-light business model and as of June 30, 2024, the company operates one central distribution center, one distribution center, and 17 regional distribution centers. The products sold by the company are manufactures by third party vendors.

Vishal Mega Mart Limited IPO Objective

As per the draft red hearing prospects, the IPO issue consists only of offer for sale.

- VIshal mega mart IPO only consist of an offer for sale (OFS) up to 1,025,641,025 shares aggregating up to Rs. 80, 000 million. Nothing from those proceeds of OFS will be allotted to company.

IPO Details of Vishal Mega Mart Limited:

| IPO Open Date | December 11, 2024 |

| IPO Close Date | December 13, 2024 |

| Basis of Allotment | December 16, 2024 |

| Listing Date | December 18, 2024 |

| Face Value | ₹10 per share |

| Price | ₹74 to ₹78 per share |

| Lot Size | 190 shares |

| Total Issue Size | 1,025,641,025 shares |

| (aggregating up to ₹8,000.00 Cr) | |

| Fresh Issue | N.A. |

| N.A. | |

| Offer For Sale | 1,025,641,025 shares |

| (aggregating up to ₹8,000.00 Cr) | |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE & NSE |

| QIB Shares Offered | Not more than 50% of the Net Issue |

| Retail Shares Offered | Not less than 35% of the Net Issue |

| NII (HNI) Shares Offered | Not less than 15% of the Net Issue |

Issue Price & Size: Vishal Mega Mart Limited IPO

The issue price of Vishal Mega Mart Limited has been declared for Rs. 74 to Rs. 78. The company only has offer for sale of Rs. 8000 crores.

Launch Date of Vishal Mega Mart Limited IPO

The IPO opening date of Vishal Mega Mart has been officially announced for December 11 to December 13.

Vishal Mega Mart Limited Financial Statements

| Particular | For the 3-mon period

ended June 30, 2024 |

FY24 | FY23 | FY22 |

| Income | ||||

| Revenue from operations | 25962.92 | 89119.46 | 75860.37 | 55885.15 |

| Other income | 76.9 | 331.81 | 328.56 | 653.36 |

| Total income | 26039.82 | 89451.27 | 76188.93 | 56538.51 |

| Expenses | ||||

| Purchases of stock-in-trade | 18223.6 | 64208.47 | 57997.17 | 42610.68 |

| Changes in inventories of stock-in-trade | 408.48 | 252.06 | -2733.85 | -2464.61 |

| Employee benefits expense | 1498.44 | 5046.95 | 4317.79 | 3377.06 |

| Depreciation and amortisation expense | 1383.28 | 5172.93 | 4614.44 | 4055.64 |

| Finance costs | 341.71 | 1435.38 | 1614.02 | 1938.08 |

| Other expenses | 2176.57 | 7125.97 | 6074.05 | 4325.17 |

| Total expenses | 24032.08 | 83241.76 | 71883.62 | 53842.02 |

| Profit before tax | 2007.74 | 6209.51 | 4305.31 | 2696.49 |

| Profit for the period | 1501.49 | 4619.35 | 3212.73 | 2027.7 |

| KPIs and financial measures | Units | For 3-mon ended June 30, 2024 | FY24 | FY23 | FY22 |

| Revenue from Operations | (Rs. in million) | 25962.92 | 89119.46 | 75860.37 | 55885.15 |

| Profit for the period/ year | (Rs. in million) | 1501.49 | 4619.35 | 3212.73 | 2027.7 |

| Net Cash flow from Operating activities | (Rs. in million) | 8239.25 | 8296.7 | 6355.34 | 6570.97 |

| Sales mix – Apparel | (Rs. in million) | 12409.24 | 39013.21 | 32926.84 | 25179.53 |

| Sales mix – Fast moving consumer goods | (Rs. in million) | 6562.41 | 24473.09 | 20319.62 | 14056.87 |

| Sales mix – General Merchandise | (Rs. in million) | 6960.78 | 25433.15 | 22383.46 | 16493.03 |

| Sales mix contribution – Apparel (% | % | 47.8 | 43.78 | 43.4 | 45.06 |

| Sales mix contribution – Fast moving consumer goods (%) | % | 25.25 | 27.46 | 26.79 | 25.15 |

| Sales mix contribution – General Merchandise (%) | % | 26.81 | 28.54 | 29.51 | 29.51 |

| Increase in revenue from operations | % | N.A. | 17.48 | 35.74 | 25.52 |

| Profit Margin | % | 5.78 | 5.18 | 4.24 | 3.63 |

| Gross Profit | (Rs. in million) | 7330.84 | 24658.9 | 20597.05 | 15739.08 |

| Gross Margin | % | 28.24 | 27.67 | 27.15 | 28.16 |

| EBITDA | (Rs. in million) | 3655.83 | 12486.01 | 10205.21 | 8036.85 |

| EBITDA Margin | % | 14.08 | 14.01 | 13.45 | 14.38 |

| Return on Capital Employed | % | 18.56 | 68.76 | 75.8 | 56.43 |

| Adjusted Return on Capital Employed | % | 29.07 | 70.95 | 92.16 | 156.34 |

| Inventory days | (No. of days) | 51 | 61 | 65 | 71 |

| Net Trade working capital days | (No. of days) | N.A. | 11 | N.A. | N.A. |

| Adjusted Same-Store Sales Growth | % | 11.63 | 13.57 | 25.16 | 11.89 |

| Retail Space | (sq. ft. million) | 11.2 | 11.01 | 10.18 | 9.14 |

| Number of Stores | (No.) | 626 | 611 | 557 | 501 |

| Average store size | (sq. ft.) | 17899.3 | 18011.56 | 18268.86 | 18250.95 |

| Revenue contribution of own brands | (Rs. in million) | 19236.22 | 63993.42 | 53479.79 | 39228.81 |

| Revenue contribution of own brands (%) | % | 74.09 | 71.81 | 70.5 | 70.2 |

| Number of Stores – Tier 1 cities | (No.) | 190 | 187 | 178 | 167 |

| Number of Stores – Tier 2 cities and beyond | (No.) | 436 | 424 | 379 | 334 |

Vishal Mega Mart Limited Promoters & Shareholding

As of date, there are two promoters of the company i.e. Samayat Services LLP (“Samayat Services”) and Kedaara Capital Fund II LLP.

The promoter along with promoter group in aggregate collectively holds 96.55% of the paid-up share capital of company.

Should You Subscribe to Vishal Mega Mart Limited IPO or Not

While investing or subscribing to any IPO, consider the investment rationales related to the company. Hence, here you can find out the strength of the company that will be its growth factors. And also check the risk factors that can affect the growth and operational efficiency of the company.

Competitive Strengths of Vishal Mega Mart Limited:

Serving diverse section of society

Vishal mega mart is a one-stop destination for middle and lower-middle income India, offering a diverse portfolio of quality, affordable, and branded products. The company serves tier 1 and tier 2 customers with stores concentration in tier 2 cities. The total addressable market is expected to grow at a CAGR of 9% by 2028. Organized retailers cater to this market, providing a streamlined retail experience, quality assurance, and sales assistance.

Follows consumer-centric approach

The company adopts a consumer-centric approach to provide variety with affordability, quality standards products, and convenience for its customers. They not only offers third party products but also sell products under their own brand.

They have the most diversified merchandise mix among offline-first diversified retailers in India, contributing over 25% to each category. They cater to middle and lower-middle income consumers by offering products across multiple price points and pack sizes.

Their stores and network area are strategically placed to cater to maximum number of customers and to offer a convenient shopping experience. In order to be in line with the competition they are offering same-day delivery in many cities. Through their loyalty program and various other initiatives their aim to keep loyal customers intact they give rewards on purchases.

Growing portfolio of own product categories

The company has a growing portfolio of its own brands products in FMCG, home furnishings, utensils and apparels, etc segment. In the FY24, 19 of these brands recorded sales exceeding Rs. 100 crores each, while six recorded sales exceeding Rs.500 crores. These brands constituted to round two-third of their total revenue from operations. The company has also expanded its product portfolio, such as the ‘Tandem’ brand for home appliances and the ‘First Crop’ brand for FMCG segment.

Pan-India Presence

The company ranks among the two leading offline-first diversified retailers in India, which operates 626 stores across Tier 1 and 370 Tier 2 cities. The company has been testing new grounds every quarter with tally rising by 16 new stores during the three months ending June 30, 2024. The company’s new store selection methodology considers factors such as population, market density, proximity to consumers, and accessibility by road. The company operates on a leasehold basis, allowing for optimal upfront investment and short payback periods. With a data base of over 50 lakh registered customers, the company has started door to door in targeted area to retain frequent clients.

| Particulars | As at June 30, 2024 | FY24 | FY23 | FY22 |

| Total number of stores | 626 | 611 | 557 | 501 |

| Stores in Tier 1 cities | 190 | 187 | 178 | 167 |

| Stores in Tier 2 cities and beyond | 436 | 424 | 379 | 334 |

Future strategy

The company wishes to

- Expand its pan-India store network.

- Expand its hyperlocal offering to expand its touch points

- Extensively use technology to identify the latest trends in fashion, general merchandise, and FMCG products.

- Drive cost-efficiencies across operations; reduce store operating costs, optimize supply chain and drive focused marketing efforts.

Risk Factors of Vishal Mega Mart Limited:

Reliant on 3rd party manufacturer

The company outsources the manufacturing of all products under its own brands to third-party vendors. These vendors manufacture products in accordance with detailed specifications provided by the company. The company’s reliance on vendors poses risks, including continuity of supply on timely basis, changes in product costs, delays in production and adverse changes in production level due to slowdown across sector. Any disruptions on the part of manufacturers will adversely affect the company’s image, its business and overall financial condition.

Inventory management

Vishal mega mart business success relies on ability to anticipate and forecast consumer demand and trends. They plan inventory and estimate sales based on seasonal forecasted demand in a capital-efficient manner. Their inventory days have reduced from 81 days in the FY22 to 52 days as of 1st QTR of FY24.

| Particulars | 3-mon ended

June 30, 2024 |

FY24 | FT23 | FY22 |

| Inventory days – apparel | 52 | 72 | 80 | 81 |

| Inventory days – general merchandise | 57 | 58 | 61 | 70 |

| Inventory days – fast-moving consumer goods | 42 | 44 | 45 | 56 |

| Inventory days | 51 | 61 | 65 | 71 |

| Net trade working capital days – apparel | N.A | 14 | N.A | N.A |

| Net trade working capital days –

general merchandise |

N.A | 10 | N.A | N.A |

| Net trade working capital days –

fast-moving consumer goods |

5 | 8 | 6 | N.A |

| Net trade working capital days | N.A | N.A | N.A |

Sales concentration

As can be seen from data in table below, the stores in UP, Karnataka and Assam contributed to one third of their revenue.. Any disruption like economic slowdowns or decrease in demand could negatively impact business fundaments and financial condition.

Below mentioned is sales data from stores in three states. These three states contribute to a significant portion, almost one third to its overall revenue.

| Particulars | As at June 30, 2024 | FY24 | FY23 | FY22 |

| Uttar Pradesh | 108 | 108 | 105 | 101 |

| Karnataka | 70 | 67 | 63 | 53 |

| Assam | 41 | 40 | 36 | 35 |

| % of revenue from operations | ||||

| Uttar Pradesh | 15.74% | 16.32% | 17.01% | 17.15% |

| Karnataka | 11.57% | 11.32% | 10.59% | 10.41% |

| Assam | 9.40% | 9.72% | 9.94% | 9.47% |

Stores on leasehold basis

The company operates its stores, distribution centers, registered and corporate offices on leasehold premises. As of June 30, 2024, the company has 626 stores and 19 distribution centers. The company faces risks associated with leasing real estate. If unable to renew lease agreements, the company may be required to relocate operations and incur additional costs. Samayat Services LLP, one of the company’s promoters, provides warehousing and transportation services.

| Particulars | As at June 30, 2024 | FY24 | FY23 | FY22 |

| Number of stores | 626 | 611 | 557 | 501 |

| Number of distribution centres* | 19 | 19 | 17 | 17 |

| Lease liabilities (current | 4565.69 | 4585.39 | 4457.44 | 4099.81 |

| Lease liabilities (non-current) | 10143.02 | 10248.49 | 8823.85 | 8821.25 |

| Total lease liabilities (Rs. in million) | 14708.71 | 14833.88 | 13281.29 | 12921.06 |

| Amortisation of right-of-use assets | 996.76 | 3781.38 | 3452.38 | 2898.67 |

| Total expenses (Rs. in million) | 24032.08 | 83241.76 | 71883.62 | 53842.02 |

| Amortisation of right-of-use assets

as a % of total expenses (%) |

4.15% | 4.55% | 4.80% | 5.38% |

Central distribution centre

As of June 30, 2024, we had 1 central distribution centre and 17 regional distribution centre, which serves as the principal hub for product dissemination across India. The central distribution centre has the largest floor area among its centre, with an aggregate floor area of approximately 0.57 million square feet. These centres act as short-term storage centers for the distribution of products to stores. The company’s geographical location makes it susceptible to regional risks, adverse changes, and events.

| Particulars | As at June 30, 2024 | FY24 | FY23 | FY22 |

| Transportation costs attributable to transport to and from central distribution centre in North India (Rs. in millions) | 342.87 | 1020.63 | 930.56 | 705.68 |

| Transportation costs attributable to transport to and from central distribution centre in North India, as a percentage of transportation expenses (%) | 63.85% | 64.69% | 66.39% | 67.95% |

Revenue from selling 3rd party products

The company has increased its own brand penetration across its product categories, but has also sold a significant amount of products from third-party brands. As can be seen from data in table below, the company generates around 25% of revenue by selling third-party product, which has been seeing a fall in comparison to precious periods. The company cannot guarantee the ability to maintain these relationships or establish new ones, as this could negatively affect the company’s business, results of operations, financial condition, and cash flows.

| Particulars | As at June 30, 2024 | FY24 | FY23 | FY22 |

| % of revenue from operations | ||||

| Sale of products from third-party brands | 25.79 | 27.97% | 29.20% | 29.53% |

| Sale of products from own brands | 74.09% | 71.81% | 70.50% | 70.20% |

Hindrances to expansion

The company plans to expand its network reach by opening stores in existing and new cities and town. The physical retail stores success depends on various factors like strategic location, integration with operations, offering in demand mix of products and effective managing its advertising, etc.

Competition may also come from organized and unorganized retailers, quick delivery stores that have strong footing in region in new cities and towns. Not all the stores launched by the company see success on its way as the company has closed some stores in the past due to unmet expectations. These high expectations can potentially adversely affecting expansion plans, business fundamentals and financial position of company.

Vishal Mega Mart Limited Grey Market premium

Grey market premium is the premium quoted over the IPO issue price. GMP shows that investors are ready to pay above the upper band of the IPO issue price. GMP is determined in the grey market as per the demand and supply of the shares in the primary market. A grey market is that unofficial ecosystem of unlisted companies’ stocks that start trading even before the launch of the IPO to the date of its listing.

Also Read: What is Grey Market Premium in IPO: How is GMP Calculated & Reliable

However, GMP is not a reliable factor, as it keeps fluctuating as per the demand and supply of shares in the primary market. There are numerous factors that affect the stock market in India and individual stock prices of different companies that are already listed and trading in the secondary market. However, for an IPO-bounded company, you can consider the GMP as the speculative listing price of the share

According to various online sources, the Grey Market Premium or GMP of the Vishal Mega Mart Limited is trading around Rs 10 in the grey market. It means shares are trading at the upper band issue price of Rs 84 with a premium in the grey market and may list around the same price.