Apart from the cash segment, there are derivatives in the stock market where a huge volume of trading takes place. And in the derivatives market, Future and Option (F&O) contracts are traded in lots of underlying securities and main indices like Nifty.

Trading in the F&O segment is not easy for the common man, you need to understand all the terminologies and mechanisms of how option trading is done and what are its components. The strike price is one of them that comes while dealing with the future and options market, so, here in this blog, we will discuss about strike prices in option trading.

Also Read: Options Trading: How it Works, Example & How to Trade

What is Strike Price for the Option?

In the derivatives market, an option is a contract that gives the buyers a right to buy or sell from the seller of the contract of an underlying security at a predetermined price. And this predetermined on which the contract is traded is called the strike price.

The strike price in options trading can be anything above or below the spot price of underlying security or indices. And the strike price of any underlying security remains the same throughout the option contract, the stock price of the asset keeps changing.

Spot Price and Strike Price

The spot price in options trading is the value of the current market price of the underlying security. In the cash market, if you buy and sell the securities on the spot, it will be available within 1 to 2 days of delivery through shares transferred into your demat account.

The price of spot prices changes during the market trading hours and the price of the same security is uniformly traded into different stock exchanges. As there are no major differences between the pricing of the same security in different exchanges, traders or market participants sometimes take advantage of these price discrepancies through arbitraging.

Strike Price Example

To make the strike price understand better, let’s take an example, suppose an investor wants to buy a call option of a stock that is trading at Rs 400 and available at a strike price of Rs. 370. Here option contract seller expects that the underlying security’s price will decrease in the future, hence to avoid major losses he wants to sell at a strike price of Rs370.

While on the other hand, another investor believes that the stock price will increase in the coming future and he expects the stock price might go up to Rs. 500. Here, the strike price selected by the seller will be the price at which the stock will be sold on the date of expiry of the contract.

Now, if the market moves and the stock price also increased to Rs. 420, then the buyer of the contract will enjoy the profit, as he purchases the stock at a lower price as per the contract that Rs. 370. And, if the stock price decreases to Rs. 300, then the seller will earn a profit by selling at the strike price of Rs. 370.

Call Option Strike Price

Call option strike price means a contract with the "right to buy" giving the owner of this contract the right to buy a stock at an agreed-upon price (strike price) at any time before or on the date of expiration.

The Call options are usually bought when the investor expects the stock price will move in the near future. And when the price goes up, the holder of this contract can exercise their option and buy the stock at the agreed strike price that is below the market price at that time, hence making profits from such options trading.

Put Option Strike Price

While on the other hand, the put option provides the owner with the "right to sell" the contract at the agreed strike price. The buyer of PUT can sell the stocks at the agreed strike price any day before the date of expiration of the contract.

Here, when a trader expects the stock price will fall in the future, then he buys a PUT option. And when the market price of the underlying stock decreases. The PUT holder can exercise their right to sell the same at the strike price that is higher than the market price at that time making the trade for the traders a profitable transaction.

Calculating Strike Price

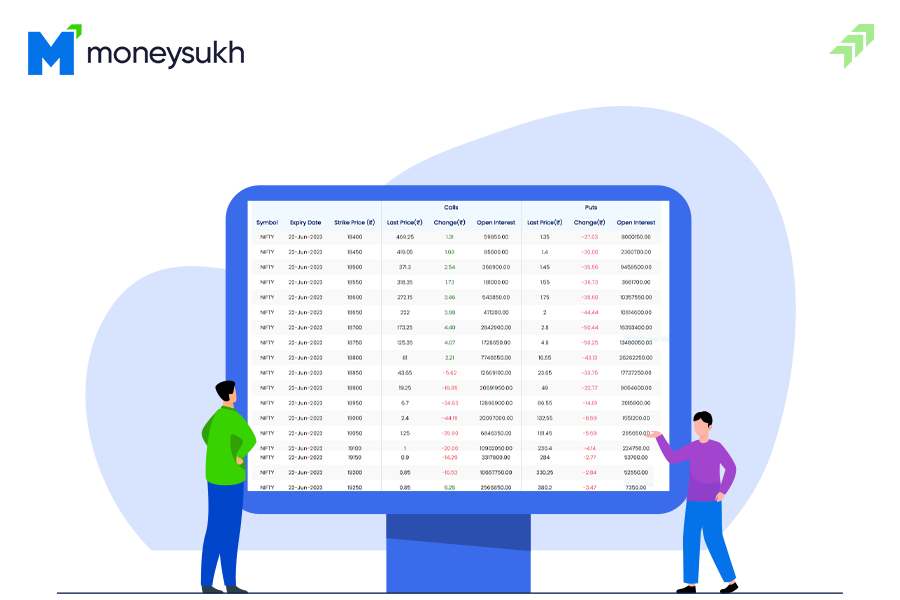

The strike price in the option chain is calculated by the stock exchange for every stock or underlying index traded in the derivative market. All the stocks are not included in the derivatives segment or eligible for options trading.

As there are certain criteria based on that, the exchange decides which security will be included in the F&O segment. The main criteria to include in the derivatives segment are high volatility, risk tolerance and standard deviation of the change in daily price. Moreover, daily trading volume and total contract value are also one of eligibility criteria.

How to Select Strike Price in Options?

Trading in the derivatives market, especially in the options chain picking the right strike price is winning half of the game-like strategy.

Yes, selecting the right strike price can make your options trading highly profitable, while on the other hand, choosing the wrong strike price can cost you huge losses. And various factors need to be taken into account while choosing the strike price in options trading. Let find out what are the points to be considered while selecting the strike price.

6 Factors to Select Strike Price in Options

#1 Tolerance for Risk

While choosing the strike price in option trading you have to consider your risk appetite. The option contracts with the strike prices nearest to the underlying asset's spot price have less risk. While on the other hand, an option contract with the strike price far away from the underlying security's spot price has a high risk.

When the strike price is deep in the money, the risk is greater. In Deep In-the-Money options trading the intrinsic value and the premium is very high, hence having higher risk. Compared to spot prices, Call Option with a very low strike price and a Put Option with a very high strike price are popular examples of deep ITM Options.

If you are a low-risk-taking trader, you can choose near ATM or OTM Options, while if you can take a higher risk with a motive to earn higher profits, you can opt for the deep ITM Options. Here you, not that, the risk for option buyers is limited to the premium paid at the time of buying the contract, while the risk for the selleris unlimited.

While choosing the strike price, another thing that should be considered is the price movement of the option along with the change in the spot price. In the Money (ITM) Options, the change in the Option price is likely to be the same as of the spot price, for example, that is every change of Re 1 in the spot price is likely to move the option price by Re 1.

While on the other hand, in the case of Out-of-the-Money (OTM) Options, the change in premium is not the same as of spot price. It mainly depends on the volatility of the underlying stock or index and the remaining time of the expiry.

#2 Implied Volatility

The amount of volatility of underlying assets is another important factor in an option contract that affects the strike price. Options contracts that are close to the money are sensitive to implied volatility. Conversely, in-the-money or out-of-the-money options are less risky to implied volatility.

The lower the implied volatility, the lower will be the contracts' premium and vice versa. And there are various factors like changes in government policies, industry-related news, and other global factors that impact the volatility of every stock.

#3 Volume or Liquidity

While choosing the strike price, volume is another important factor you need to consider while trading into an option contract. Because without volume there will not be enough liquidity in the market to buy or sell that underlying security.

Also Read: Importance of Volume in Technical Analysis: Use & Role in Trading

And in options trading, the liquidity of the security determines the profitability of the trade. Securities having higher liquidity provide better profits before the expiry of the contract. In options trading, a strike price with higher open interest shows liquidity.

Also Read: Nifty Open Interest: How Traders Use Change in Nifty OI for Data Analysis

An option contract with a strike price either deep “in-the-Money” or deep “out of the money” have less liquidity, which means the bid/ask spreadis widespread and not suitable for trading.

#4 Risk-to-Reward Ratio

Risk to reward ratio is another important factor you should take into account while picking the strike price for option trading. It is the ratio of how much money or value is being invested to get the expected returns or other value is the risk-to-reward ratio.

And after calculating the various risk-to-reward ratios for different strike prices based on the fundamental and technical analysis along with their risk-taking ability, the buyer and seller agree to choose the right strike price.

Also Read: Difference Between Fundamental Analysis and Technical Analysis

#5 Check the Time Decay

The option contract with ATM or "at-the-Money" strike prices is also highly affected by the time decay compared to OTM and ITM strikes.

As soon as the date for expiry comes, the value of the premium of the strike price is too far away from the spot price and is also affected at a very high speed. And the reason behind that is ATM most traded strike price contracts in terms of volume and open interest making this contract attractive for traders.

#6 Check the Bid-ask Spread

Before executing the trade of a particular strike price, also check the bid-ask spread. As the strike price with the low liquidity has big gaps between the bid and offer price. However, sometimes traders also check the "last traded price" and enter the trade without checking the bidding offer price, which resulted, in unexecuted orders and hunting the price.

Summing-up

The strike price in options trading is an important factor that can determine the premium that you are going to pay and the possibility of profit you can earn.

While trading into the options you can see the different strike prices of underlying securities, some of them are out-of-the-money and many of the in-the-money, but you see the volume or liquidity into the contract of strike price nearest to the spot price of the underlying security or indices.

And not all the underlying security or indices need to have the same volume in strike prices, most of them have low volume and liquidity.

And only the blue chip companies with high volatility and volume in the cash market also have demand in the derivatives market. Similarly, only the main underlying indices have a high volume in different strike prices, otherwise, the most spread strike prices are not suitable for option trading. Here you can take help from the expert to trade in options.

Moneysukh offers seamless trading as well as investing experience in the cash as well as derivatives market with the best trading plans for retail clients. Moneysukh provides trading in equity, commodity and currency with demat account and free trading account facility to make the trading experience less costly and highly profitable.

And this would be possible with a strong research team who can recommend you the best option strategies for bearish market or bullish market and as per the different market conditions. It is also providing the daily tips and recommendations to clients on their mobile with quick update to book profits to earn highest profits and minimize the losses.

Also Read: How to Be a Good Investor or Trader to Buy Best Stocks in 2023

No comment yet, add your voice below!