Trading in options you can find the combination of various strategies as per the market conditions and you risk and reward outlook. You can choose from simple to complex level of option strategies designed for different market situations for different types of traders.

The lower and simple strategies are less complex and less risky but suitable for beginners or inexperienced traders. While the high level of complex strategies can give you high returns but have a high potential of risks. As per the market experts option strategies are categorized into four different levels. Here we are going to talk about what are the different levels of advanced options strategies you can choose to trade in the option market.

4 Levels of Advanced Options Strategies

The levels of option strategy define the level of complexity and you can choose the right one as per your use. These strategies are designed for different types of traders as per their risk tolerance and expectation of returns from the market. Each progressive level of strategy becomes more complex making the trading risker in the highest levels of strategy.

Level 1 Option Strategies- Covered Calls &Cash Secured Puts

This strategy is less risky compared to other highly complicated strategies and suitable for the traders who are new in the option trading market. In this strategy, you should have the underlying stock and at the same time also sell the call options so that you can generate additional income through receiving the premium by selling the calls.

Also Read: What is Put Call Ratio & How to Use it for Options Trading

While on the other hand, you also need sufficient funds in your bank account to buy the stocks if the put is exercised the puts. This level of strategy is considered the safest one, as you have the underlying security and funds to cover potential purchases. Hence, this strategy is suitable for conservative investors looking for a steady income.

Level 2 Option Strategies – Long Options

In this level of option strategy, you need to trade in long positions like buying calls and puts. Long puts give you the benefit of gaining your contract value when the price of the underlying security decreases. While your long calls will give you the advantage of the increase in the contract value when the price of the underlying security moves upside.

Here the strike price and premium underwrite the breakeven point for the investor and offer more potential for rewards. Buying calls provides you with the right to buy the stocks at a predefined price while buying the puts gives you the right to sell the shares.

This level of option strategy is useful for traders looking to take advantage of the speculation on market movement. However, few traders exit from their trade position before the date of expiry if its value increases. As the option contract reaches its expiry level will lose its value, especially if the contract is in deep out of money. Hence, an option contract needs to be kept moving before the expiry to avoid the impact of the time decay.

Also Read: What are the Delta, Gamma, Theta and Vega in Option Trading

Level 3 Option Strategies – Option Spreads

In this little more complex level of option strategy, you have to trade in multiple contracts of the same underlying security. However, as per your trading objectives, you can choose the strike price and expiration date. You can reduce your net cost of trade by selling a call of the same expiration date price but at a higher strike price.

Also Read: How to Choose or Pick the Right Strike Price in Option Trading

The profit potential in this strategy is limited difference between the buy call strike price and the short call strike minus the net debit paid. This strategy offers more controlled profit scenarios and can limit risk compared to straight long options. However, the option spread can be more complicated and needs additional understanding of the option market.

Level 4 Option Strategies- Naked Calls and Puts

This is one of the most complicated as well as riskiest levels in the option trading. Under this strategy, you can sell, the options even without holding the shares of the underlying security and also not have sufficient funds to cover your other options trade positions.

Trading in this strategy is highly risky, especially when trading in naked calls as such an uncovered trade position can go into losses, beyond your investments.A naked call possesses unlimited risk, as there is no cap on how much the price of the underlying security can go.

While naked puts also have the risk of potential losses you can offset some losses with the premium you received. Apart from that to sell the options, you also, need extra funds to deposit as the margin money. Hence, if you have deep knowledge and experience in trading at these levels, then you should enter into the trade positions.

How to Choose the Right Level of Option for Trading?

Choosing the right level for trading in the option strategy is not that difficult as each level has its own risk and level of complexity. You can choose to trade the right one that you can understand and possible for you to enter into multiple trade positions as per your risk tolerance and reward expectations from the market.

Also Read: Why Option Selling is Better than Option Buying: Explained

If you have recently started trading in options, you should start with the first level. However, if you are a veteran in this segment with a clear understanding of every aspect affecting the option price, then you can take a risk and choose to trade with level 4. But still, you should start with level 2 and level 3 and later try the fourth one when you earn profits in these levels.

Points to Consider While Choosing the Trading Level:

Market Condition: The first thing before you choose the trading level is to understand the market condition and the trend so that you can decide which strategy will work. If the market is running in a single direction especially upwards, you can choose level one, which is less risky and would be suitable for you as per your experience in options trading.

Also Read: How to Use Traderadar for Option Strategies as Market Conditions

Market Depth: To choose the right level, you also need to understand the depth of the market. Check the bid & ask spread and the size of various orders in your targeted underlying security. You need to interpret the quantity of shares traded and available for trading with its significant price movement, to identify the support and resistance levels. Analysing the market depth is very important to understand the level of complexities.

Also Read: How to Use Market Depth for Intraday Trading Strategy

Volatility Level: Volatility is one of the major aspects you need to consider while choosing the right level for trading. Implied volatility shows the range of movement where the market or underlying security can move. High volatility means, you need to trade with more safe strategies to cover your positions and minimize the impact of volatility. While in low volatility, you can trade in the next levels with uncovered trading strategies with naked positions.

Also Read: How to Use Implied Volatility in Options Trading: Strategies

Risk Level: Identifying the level of risk using volatility and other tools is also very important to choose the right level as per your risk tolerance. If the market or underlying security is in a high-risk zone and you are ready to take the risk, you can trade in level 3 or 4. While for the low-risk traders or market trading into the low-risk zone, you can pick level 1 or 2 to trade in options. To trade in such a market, you need to trade with a proper risk management strategy.

Also Read: How to Manage or Do Risk Management in Options Trading

Fund Requirement: Trading into the short positions in options you need an extra amount of funds to deposit as the margin of money. Compared to long positions in options, while selling the calls or puts you should have an additional amount of funds to enter into such trade positions. Hence, you can choose the right level of option trading strategy as per the fund availability.

Also Read: What is F&O Margin Penalty: SEBI Rules & How to Avoid it

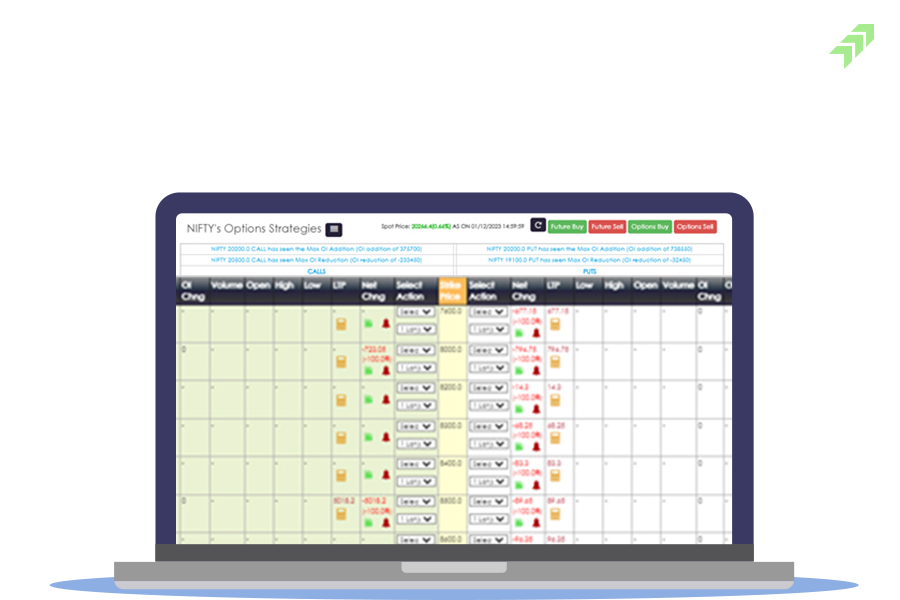

Right Platform: One of the most important factors while choosing the right level for option trading is choosing the right platform that can provide you with all the resources to trade in your desired strategy. Here look for the best online trading platform that is not only user-friendly but also provides the right tools and indicators to analyse the market and make the right decision. You can also choose the right Algo Trading platform to trade in various option strategies.

How to Know Which Level Option Strategy You Are Eligible?

To know which level of option strategy is suitable for you or in which you are allowed to trade, you need to consult with your broker. However, if you are using an online trading platform, you can check your demat and trading account and find out what trades are available for you.

Also Read: Key Points to Consider While Opening a Trading Account Online

Though the option strategies are categorised into various levels, you can choose the right one as per your understanding and risk levels in various options.

Combination of Option Strategies into Different Levels:

| Levels | Option Strategies |

| Level 1 | Covered Calls, Covered Basket Calls, Covered Puts, Call Options and Buy Writes, Unwinds |

| Level 2 | Cash-Secured Puts, Long option positions, Long Call, Long Put, Covered Put, Protective Call, Protective Put, Long Straddle, Long Strangle, Conversion, Long call spread, Long put spread, Long Iron Condor, Long Box Spread, Collar and Short Collar |

| Level 3 | Short Put, Synthetic, Reversal, Short Call Spread, Short Iron Condor, Short Put Spread, Unbalanced Butterfly, Long Butterfly, Short Butterfly, Calendar Spread – Debit, Diagonal Spread – Short leg expires first, Ratio Spreads and Option Spreads

|

| Level 4 | Uncovered Calls, Uncovered Puts, Uncovered Ratio Spreads, Short Naked Call, Short Straddle, Short Strangle, Short Synthetic, Calendar Spread – Credit and Diagonal Spread – Long leg expires first |

How to Move Next Level in Option Trade?

Trading in a particular level is not bound for anyone, you can move to the next level as soon as you become more proficient in option trade and making profits in initial levels. However, if your broker has categorised into a particular level, especially in level 1 or 2 and you want to move to the next one, you need to send the request with a valid reason to allow you to trade in high levels.

However, sometimes best discount brokers in India automatically upgrade the account of their clients to the next level depending on the trading activities, experience level and age eligibility to trade in high-level option strategies. If you have a consistently good track record of trading with profitability in lower levels, you can easily move to the next levels.

However sometimes you are not allowed to move to high levels, the main reason behind that you have to maintain a high amount of capital in your trading account. And maybe you are not experienced enough to trade in such high-risk trading levels. Here you should maintain good capital in your trading account and improve your trading performance to become eligible.

Summing-up

The different levels of the option strategies are designed and created for different types of traders. New or inexperienced traders are recommended to trade in level 1 and move gradually as per their gaining knowledge and experience. In level 1 you can choose to trade option strategies like covered calls, covered puts and trade with mostly covered trade positions.

Also Read: Best Option Strategies for Sideways or Range Bound Market

While, in Level 2, you can find a wide range of option strategies like Long calls, long puts, protective calls & puts and long straddle & strangle. Whereas in Level 3 you can choose from popular option strategies like Long or Short &Unbalanced Butterfly, Short Iron Condor, Short Put Spread,Short Call Spread and other Option Spreads.

Also Read: Best Option Strategy for Bearish Market: 7 Option Strategies

However, the fourth level is the most complex as well as riskiest to trade only recommended for the highly experienced traders. At this level, you can trade in Uncovered Calls or Puts and Uncovered Ratio Spreads, Short Straddle or Strangle& Synthetic and short naked calls. But make sure which one is suitable for you as per your understanding, funds availability and ability to take risks.

Also Read: Algo or Manual Trading Which one is better for the Option Market