Algo trading platforms come with automated solutions of various functions that traders usually perform manually while trading in the options market. Apart from directly placing the simple orders and choosing any call or put, you can also create an algo trading strategy as per the current market conditions and your expectations from the market.

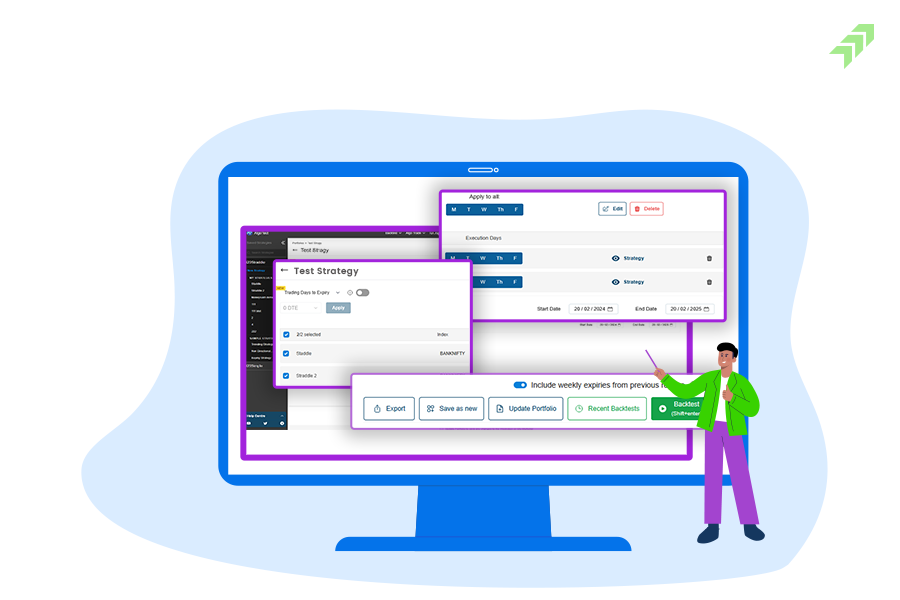

Algo Test is featured with such advanced functions that, apart from most common or popular algo trading strategies, you can also build your own strategy here. The function is now also integrated into the Trade Radar through the Algo Test making it easier for option traders to trade with their own strategy. Let’s find out how you can create a strategy in Algo Test.

Creating Strategies with Strategy Builder

Using the Algo Test in your Algo trading software like Trade Radar, you can either create simple or most basic strategies picking the underlying assets and strike price as per your choice. You can also use the pre-build strategies where you can find the most popular and effective option trading strategies or trade with the most advanced strategies.

How to Create Basic Strategies?

Using this section of strategy builder, you can create the basic strategies choosing the underlying security as per your own choice. You can select the underlying security with an option chain to select the call or put different strike prices of different expiry dates. You can find the stepwise guidance to create the basic strategies in Algo Test.

Step 1: Select the Underlying Asset

Here you need to choose the index options from the list, in which you want to create the strategy. You can find here all the leading indices traded in options Nifty or Bannifty etc.

Step 2: Select the Option Type

Now you can select the type of option like call or put as per your bullish or bearish outlook respectively and based on the market condition.

Step 3: Select Strike Price

You can also choose the strike price you want for the underlying security as per your strategy. In option, trading selecting the right strike price is very important to optimize the cost and potential returns of your strategy.

Also Read: How to Choose or Pick the Right Strike Price in Option Trading

Step 4: Select Expiry Date

You can also select the expiration date for your option contract. By default, the option chain data of the selected underlying security of the nearest expiry date is visible in the window.

Step 5: Select the No of Quantity

Using this section, you can select the number of quantity of contracts you want to buy or sell in your strategy. The quantity is multiplied as per the pre-defined contract size of different underlying.

How to Use Pre-Built Strategies?

Apart from creating simple strategies, you can also use the pre-built strategies templates. Using this feature you can directly select the popular strategies like Straddle, Strangle, Bull Call Spread, Bear Put Spread, Iron Fly Iron Condor etc.

Steps to use Pre-Built Strategies:

Step 1: First, open the Algo Test through the Trade Radar login panel.

Step 2: Now click on the Strategy Builder button on Algo Test

Step 3:When you click on “Strategy Builder”, you can see the top strategies on the left side.

Step 4: You can select any particular strategy to seethe combination of options here.

Step 5: Here you can choose expiry date, strike price or modify the lot size and price.

Once you have selected the strategy as per your choice, and customised all the parameters as per your expectations, fund availability and risk-bearing capability you can apply the strategy by clicking on Live Trade with the option given at the bottom.

How to Use Advanced Strategy Options?

Apart from the most common pre-built strategies, you can also trade with the most advanced strategies integrated into the Algo Test. In this advanced strategy builder, you can create a combination of multiple option contracts as per the current market conditions and your risk profile with your expectation to get a return from the directional range-bound movement.

Using this section you can trade with the most advanced strategies like Bull Put Spread, Bear Call Spread, Ratio Spread, Diagonal Call/Put Strategy and a combination of Futures with Options Combined Strategies as per your view on market movement.

You can also customize the parameters like buying or selling or call or put and choose the right strike price or adjust the lot size and execution price as per your strategy. On the right panel along with the payoff graphs, you can see the maximum loss or profit with the margin of money you required to enter into this trade position.

How to Analyse Your Strategy in Algo Test?

After creating your strategy, using the strategy builder in Algo Test you can also analyse your strategy, its Payoff Graphs, how it will work and it’s various aspects like profitability, risk or reward withmaximum loss, breakeven and margin of money required to trade.

Step 1: Analyze Payoff Graphs

You can analyse your built strategy using the Payoff Graphs that are automatically created when you select all the parameters as per your preference. This graph can easily show you the visual representation of potential profits or losses on the execution of the strategy.

The X-axis on this graph shows the price of the underlying security of a particular expiration date. While the Y-axis shows your potential profit or loss. The line on the graph represents the current payoff at different prices of the underlying security. While the blue line shows the potential profit and loss at different underlying prices on that particular expiration date.

Step 2: Total MTM

This mark-to-market shows the current total profit or loss (realized + unrealized) of your strategy.

Step 3: Maximum Profit

This important section will show the maximum profit you can earn from this strategy if the market or selected underlying index moves as per your expectation by the date of expiry. However, you can adjust the profitability level as per your expectations of reward from this strategy.

Step 4: RiskReward Ratio

This shows the relationship between the risk and potential reward from your strategy. Checking this ratio you can tune the various parameters of your strategy as per your risk and reward ratio you can take while trading in the option market with this strategy.

Also Read: Types of Risks Associated with Investing in the Stock Market

Step 5: Maximum Loss

From here you can see the maximum potential loss you may incur trading with this strategy if the market or selected underlying security moves against your expectations. This information in the Algo Test strategy builder will help you to trade with the right risk management.

Step 6: Margin Approx

Trade in options you need a certain margin as per your trade positions in the strategy, and you can see this information here in Algo Test. It shows the approximate margin required to execute your strategy through your broker helping traders to avoid margin calls from the broker or avoid the margin penalties imposed by the exchanges.

Step 7: Breakeven

This is another useful information you can utilize while analysing your strategy. Yes, this shows the price of the underlying security at which if your trade position expires, it will be at the break-even point. It shows the breakeven point with the percentage of range within which if underlying security expires, then it will be at the breakeven point.

Summing-up

Using the strategy builder section in Algo Test through the Trade Radar login panel you can create and manage your option strategies. Here you create either basic or simple option strategies or can choose from the pre-built popular strategies for various market conditions.

Apart from this, you can also choose the most advanced options strategies with the facility to fully customize your strategy as per your risk profile and expected rewards. Using this section after creating your strategy you can also analyse certain aspects of your strategy like profitability, potential losses and risk-reward ratio with the margin of money required to execute your strategy.