Placing the orders in option trading becomes easier with smart options that offer an effortless trading experience for traders. If you use to trade in option indices, then “Smart Options” would be the best online trading platform that comes with various interactive features.

We have already discussed how you can place simple orders to enter into a trade position in the Smart Options. But if you want to place other than market orders like limit orders or basket orders there is little different procedure. Let’s find out how to place limit and basket orders.

How to Place the Limit Order in Smart Options?

Limit orders are different from market orders allowing the traders to decide their own price at which he or she want to buy or sell the security. When you place your order at a market price of the underlying security, then it’s called the market orders, and when you set the price above or below the market price then it is called the limit orders and such orders executed only price meets the order qualifications.

Also Read: What are the Different Types of Orders in Stock Market Trading

When you buy a security, the limit order will be at the limit price or a lower price, while at the time of selling the security, the limit order will be the limit price or a higher one. There is no guarantee the limit orders will be executed as unless the price reaches your limit price it will be not executed. In option trading you can use the limit orders, let’s find out how to place limit orders in smart options.

Also Read: Types of Orders in Option Trading in Algo with Order Placement Tips

Steps to Place Limit Order in Smart Options:

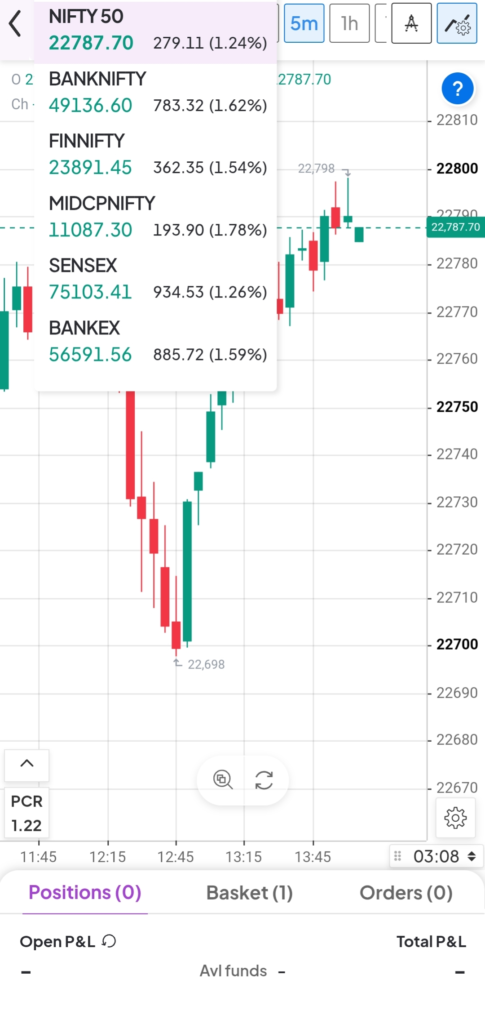

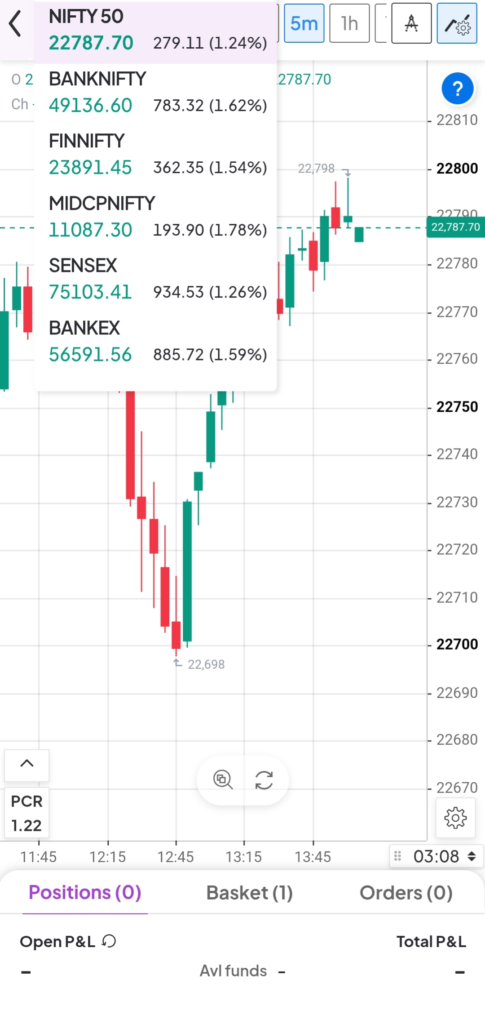

Step 1: First of all select the underlying index you want to trade.

Step 2: Suppose you choose Nifty 50, and then select the strike price.

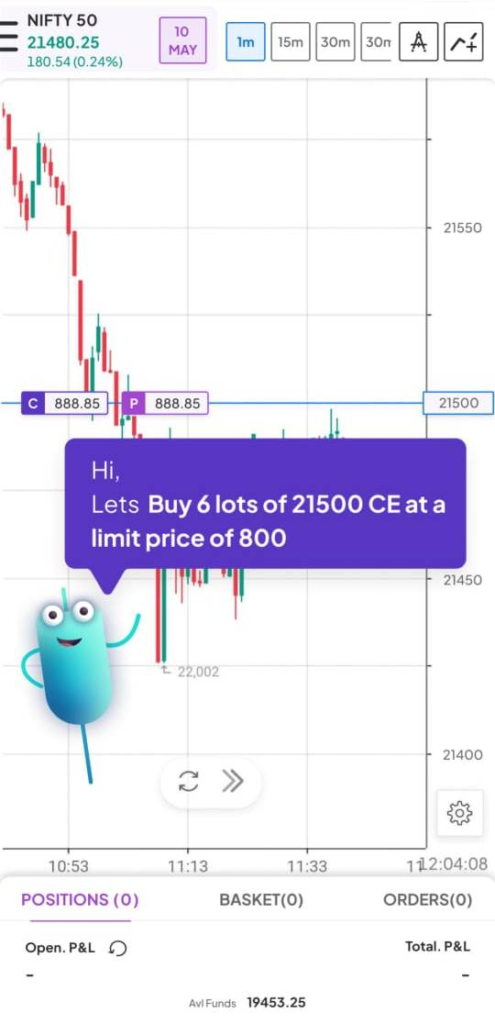

Step 3: If you want to buy a call option, then select the CE on the selected strike price.

Step 4: After selecting the CE you can choose quantity, order type and SL & TGT.

Step 5: Here next to quantity you can see the option to select the limit or market order.

Step 6: After selecting the market type, drag the CE option price at your desired limit price.

Step 7: After setting the limit price at 850, now have to place the order.

Step 8: Now you can see the “Buy” option at the right bottom, just swipe right to place the order.

Here your order will be placed at your desired limit price that you set or modify as per your wish. However, the orders placed with the limit price are executed only when underlying security reaches at your limit price during the market hours, otherwise order will be cancelled end of the day when not executed. Similarly, in the Smart Options trading app, you can place multiple orders through basket orders.

Also Read: What is Order Flow in Trading? Analysis and Trading Strategy

How to Place Basket Orders in Smart Options?

Basket order is the type of order technique in which you can place multiple orders at the same time. You can select multiple securities or in option, trading you can select the multiple strike price contract of the same underlying security and place all the orders at the same time.

Also Read: How to Choose or Pick the Right Strike Price in Option Trading

In Smart Options, to trade in the option indices you can place the basket orders as per your trading strategy. Trading with basket orders, you can create multiple trade positions, add them into the basket, and place all of them together to enter into multiple trade positions at one time. To understand how to place basket orders in the Smart Options, you can follow the steps given below.

Steps to Place Basket Orders in Smart Options:

Step 1: First, select the underlying security you want to trade in the Graph.

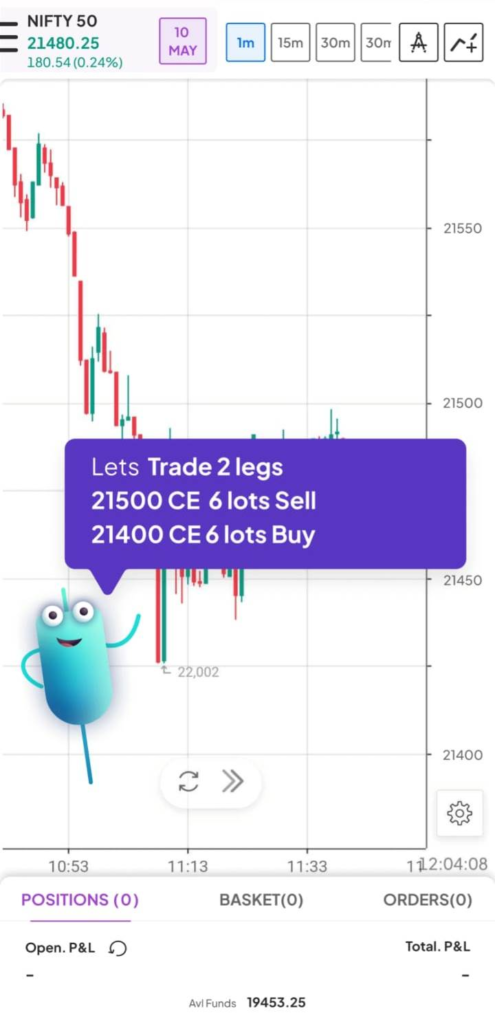

Step 2: Suppose you want to buy, two call options of different strike prices of Nifty 50.

Step 3: Then select the first strike price (21500) on the Y-axis to see the call option price.

Step 4: After selecting the strike price you can see the Call option, just click on that.

Step 5: Once you click on CE, you can see the option to buy or sell the same.

Step 6: Now you have to click on the basket icon below to add this leg to the basket.

Step 7: Before that, you have to select the lots or quantity of this trade position.

Step 8: Now you can see the orders added in the basket can be seen here.

Step 9: Here you just need to swipe down to select the sell order.

Step 10: Not tap on another strike price (21450) on the Y-axis to add another order to the basket.

Step 12: After selecting the strike price, you just need to follow the same steps to buy 6 lots of 21450 CE.

Step 13: Now at the bottom you can see both legs or orders are added to the basket.

Step 14: Just swipe on the right side to place the basket order.

Step 15: If you want to edit, modify or remove any order just swipe on the left-hand side.

Step 16: To view the legs in the basket you can swipe on the upside.

To enter multiple trade positions at the same time using the basket orders is the best option. This not only helps your time and efforts but also improves efficiency and reduces the margins. In option trading, especially when the market is volatile, as an options strategy you need to enter into multiple trade positions at the same time. The basket order facility helps you to trade as per your strategy.

Also Read: How to Trade in High Volatile Market: Best Trading Strategies

Summing-up

Just like other trading apps, in Smart Options you can use the limit order facility to place the order as per your desired price. You just need to select the underlying index and choose the right strike price, then quantity and limit price to place the order as per your selected price. However, such orders are executed only when the market price of the underlying security touches the price during trading hours.

Also Read: Why Choose Algorithmic Software for Options Trading: 10 Reasons

Similarly, you can use the Smart Options to place the basket orders for option indices. You just need to choose the underlying and then strike prices and quantity to add them into the basket. Once you select different strike prices CE or PE, you can place the orders into the basket for the execution. You can edit, modify or remove any order or can view the legs in the orders. To enjoy this feature just open a demat account with Moneysukh and login into the Moneysukh Pro app to trade with Smart Options.