Nexus Select Trust is the owner of India’s leading consumption centre platform of high-quality assets that serve as essential consumption infrastructure for India’s growing middle class. The Portfolio comprises 17 best-in-class Grade A urban consumption centres with a total Leasable Area of 9.2 msf, two complementary hotel assets (354 keys) and three office assets (1.3 msf). The Portfolio has a tenant base of 1,044 domestic and international brands with 2,893 stores as of December 31, 2022 and is well diversified across cities with no single asset and tenant contributing more than 18.3% and 2.8% of total Gross Rentals for the month of December 31, 2022, respectively. The Portfolio is highly stabilized with Committed Occupancy of 96.2% and 5.7-year WALE as of December 31, 2022, but has strong embedded growth prospects. It is well-positioned for strong organic growth through a combination of contractual rent escalations, increased tenant sales leading to higher Turnover Rentals and re-leasing at higher market rents, and lease-up of vacant area.

The Nexus Select Trust has a strong track record of delivering inorganic growth through accretive acquisitions and is well-positioned to scale inorganically. Over the last three fiscal years and nine months, the Portfolio has leased 4.2 msf, added 408 new brands to its tenant base, and achieved average Re-leasing Spreads of 19.2%. Additionally, the Portfolio has consistently maintained over 90% Same-store Committed Occupancy. The Nexus Select Trust has achieved a 7.5% CAGR in Marginal Rents across their Portfolio from CY16 to CY19, a 11.0% CAGR1 in tenant sales between FY18 to FY20, and increased their Portfolio by 4.6 msf through strategic acquisitions and accretive build-outs. Additionally, they have implemented over 50 ESG initiatives, including renewable power plants and COVID-19 vaccination campaigns, which have resulted in their Portfolio receiving a Global Real Estate Sustainability Benchmark (GRESB) score of 76 out of 100 as of 2022, and obtained Platinum/Gold Indian Green Building Council (“IGBC”) ratings across 16 urban consumption centres and two.

| Particulars | Details |

| IPO open date | 09 May '23 |

| IPO close date | 11 May '23 |

| Minimum Investment | 1 lot for Rs. 15,000 |

| Lot size | 150 Shares |

| Issue Size | Rs. 3200 cr |

| Fresh issue | Rs. 1400 cr |

| Offer for sale | Rs. 1800 cr |

| Price Range | Rs. 95 – Rs. 100 |

| Basis of allotment | May 16 ’23 |

| Listing date | May 19 ’23 |

Strengths

Located in one of the world's fastest growing economy

India is one of the fastest growing economies, and consumption is a key driver of its economy. Consumption accounted for 59.6% of GDP in FY22 and has grown at 10.0% CAGR, 150 bps higher than China. Our Portfolio is well-positioned to capitalize on this growth.

India's largest platform of best-in-class assets.

They own 17 best-in-class urban consumption centres across 14 cities, representing 30% of India's total discretionary retail spending in FY20. They are able to maintain high levels of Committed Occupancy and negotiate competitive lease terms with our tenants, leading to a 3.8% Marginal Rent premium.

Diverse tenant base of national and international brands.

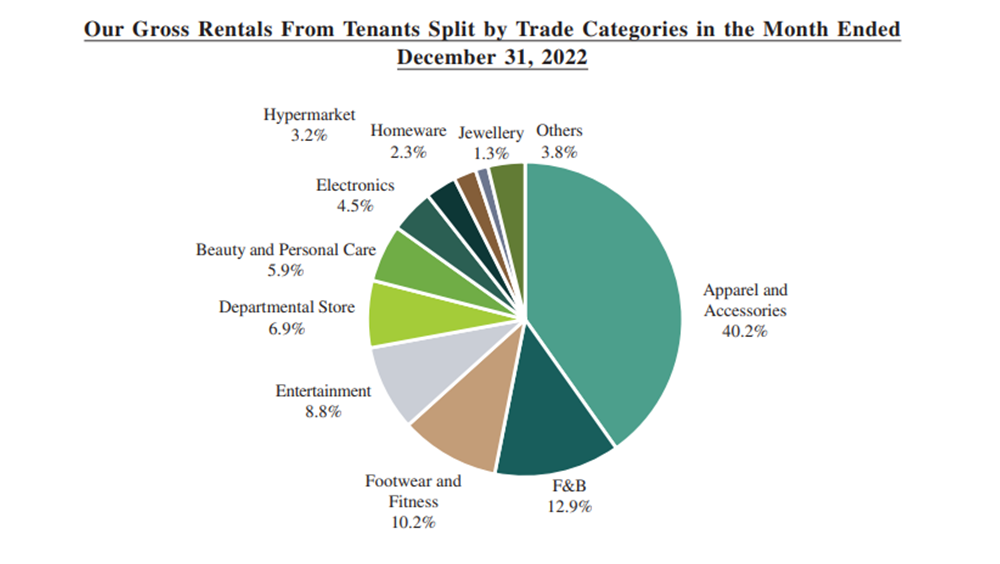

Company’s assets had 93.9% Same-store Committed Occupancy as of June 30, 2022, with an average WALE of 5.7 years. As of December 31, 2022, they had 1,044 high quality retail tenants across 2,893 stores. The tenant base is well diversified, with top ten tenants contributing only 20.2% of our Gross Rentals. Leases in India are typically on a "warm shell" basis, resulting in landlords incurring TI capex while tenants incur significant cost. This results in tenant 'stickiness' and enhances NOI to cash flow conversion.

Strong embedded growth with inflation hedged cash flows.

Nexus Select Trust is well-positioned for strong organic growth through contractual rent escalations, increased tenant sales leading to higher Turnover Rentals, re-leasing at higher market rents and lease-up of vacant area. These primary revenue drivers are expected to drive 89.4% of the projected increase in NOI over the Projections Period. Additionally, they have a strong track record of delivering inorganic growth through acquisitions of stabilised assets and turnaround of underperforming assets. The most important details are that the company has re-leased at market rents, lease-up of existing vacancy, and has a strong track record of acquiring and turning around underperforming retail assets. Market Rents for the assets are 16.1% higher than In-place Rents as of December 31, 2022, and the company has acquired 17 high quality retail assets since 2016. The management team has a proven track record of repositioning and turning around underperforming assets through strategic capital expenditure and leasing initiatives.

Strategically located in prime in-fill locations with high barriers to entry.

Their 17 Grade A urban consumption centres are strategically located across 14 prominent cities such as Delhi, Navi Mumbai, Bengaluru, Pune, Hyderabad, and Chennai. The assets are located in city-center locations in close proximity to dense residential catchments and are well-connected to key transport and social infrastructure. Despite strong demand for high-quality retail space in India, existing stock in the country is limited to approximately 100 Grade A urban consumption centres. This constrained supply has resulted in low vacancy rates for Grade A assets in India, which remained at 10% on average over the last five years. This trend of strong demand coupled with limited supply is expected to continue with only 9.6 msf of new supply expected until 2024, which is expected to result in a decline in average vacancy by 271 bps as compared to CY21.

Threats

Large tenants have a significant impact on business.

Revenues from operations are concentrated in a few large tenants and in a limited number of properties. Gross Rentals from top ten tenants (by Gross Rental contribution) accounted for 20.2% of our combined Gross Rentals for the month ended December 31, 2022. Top ten tenants (by Occupied Area) occupied 33.7% of our Occupied Area as of December 31, 2022. Even if they seek to diversify our tenant base, several of our tenants may belong to one or more large conglomerates with wide ranging interests. Their reliance on a small number of tenants for a significant portion of our revenues may give the tenant a degree of pricing leverage against us.

Manage growth effectively to ensure success.

Nexus Select Trust 56 has experienced significant expansion in the last three fiscal years and nine months. They have leased 4.2 msf, added 408 new brands, and achieved average Re-leasing Spreads of 19.2%. They have maintained over 90% Same-store Committed Occupancy and achieved 7.5% CAGR in Marginal Rents and 11.0% CAGR in tenant sales. To manage operations and business growth, they will need to grow and improve their operational, financial, and management controls and reporting systems and procedures. They will also need to ensure full and immediate compliance with changing regulatory or commercial requirements.

Has a Rs.5,662 cr outstanding debt as of Sep 2022 which may affect operations and cash flow.

Supply, Absorption, Vacancy Trends

The Nexus Select Trust Markets have experienced modest new supply over the last five years due to scarcity of land in key residential catchments. Projected supply for H2 2022, 2023 and 2024 is at 2.2 msf, 1.9 msf and 1.6 msf respectively. Tenant demand of Grade-A retail developments has kept the vacancy level stable despite COVID-19 and is projected to decline to 6.9% by end of 2024.

Competitors of the Company

As per the DRHP of the company, there are no direct competitors of the company. However, there are three other REITs listed in the Indian stock exchanges- Embassy Office Parks REIT, Mindspace Business Parks REIT, and Brookfield India Real Estate Trust

Also Read: How Shares are Allotted in Oversubscribed IPO

Financial Statement

Profit and Loss

RECOMMENDATION -: RATIONALE TO SUBSCRIBE

No comment yet, add your voice below!