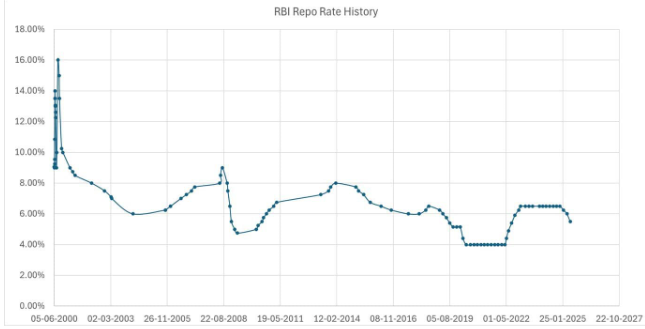

In an important decision to stimulate economic growth, the Reserve Bank of India (RBI) cut the repo rate by 50 bps in June 2025, decreasing from 6.50% to 6.00%. It signaled the central bank’s strong commitment to support domestic demand amid a backdrop of moderating inflation and global uncertainty. This was the largest rate cut in five years. The repo rate plays a crucial role in deciding interest rates across the banking system; it is the rate at which the RBI lends money to commercial banks. It encourages spending and investment because a reduction in this rate typically leads to lower loan EMIs for consumers and reduced borrowing costs for businesses.

This strong decision came at a point when India’s GDP growth was showing early indicators of slowing, inflation remained well within the RBI’s target band of 4-6%, and global trade tensions were affecting exports. The aim of the RBI is to revive private sector investment, support job creation, and keep India on track to maintain its position as the world’s fastest-growing major economy by cutting rates.

Why Did the RBI Cut Rates So Aggressively?

RBI Reserve Bank of India surprised by cutting the repo rate by 50bps in June 2025, which is the biggest cut in several years. As the Indian economy started showing signs of slowing down, this aggressive move was made with the clear intention of giving a strong push to the Indian economy. The growth of GDP had softened slightly, but India remained one of the fastest-growing major economies in the world. By making borrowing cheaper, the RBI saw this as an opportunity to revive momentum. Individuals are more likely to take loans for homes, vehicles, and businesses, and companies are more likely to invest in new projects when interest rates fall. This brings the economy closer to the 7–8% growth target set by policymakers.

Inflation was under control, which is another important reason for the rate cut. The rise in prices of goods and services is measured by the Consumer Price Index (CPI), which is under the RBI’s comfort range of 4% to 6%. Without worrying about inflation getting out of hand, it allowed the central bank to cut rates. The RBI had the freedom to act decisively with stable prices.

The RBI decision was also influenced by global factors. The trade tensions, falling exports, and unpredictable oil prices uncertainty were affecting the world economy. The economic performance of India could be hurt by these factors. The RBI wanted to strengthen domestic demand to make sure that India remained resilient despite these global headwinds. The central bank aimed to keep consumption and investment strong at home, even if global demand was weakening, by making loans more affordable.

Lastly, the RBI is thinking of encouraging more private sector investment. Private companies had been slow to invest despite strong government spending on infrastructure. High borrowing costs were one reason. The RBI aimed to reduce this burden and make it easier for businesses to access capital by lowering interest rates. It improves conditions and shifts towards new factories, more jobs, and increased economic activity. To support growth, take advantage of low inflation, and shield the Indian economy from global risk, it is a strategic and timely decision of the RBI.

What Does This Mean for Different Stakeholders?

It has a wide-ranging impact across different sections of the economy of the RBI’s decision to cut interest rates. This move means Banks now have to pay lower interest when borrowing money from the RBI, which results in many banks deciding to lower the interest rates they charge on loans and mortgages. It often leads to a rise in credit demand because it makes borrowing cheaper for customers. People may take more loans for homes, cars, or businesses, but banks might earn slightly less in interest income in the short term due to these lower rates.

From the consumer’s point of view, it is generally good news because low interest rates make home loans, car loans, and personal loans become more affordable. This increased buying power and lower EMIs (equated monthly installments) make it easier for people to buy big-ticket items, which is good for the economy.

Lower interest rates from a business perspective are beneficial. It is easier to invest in expanding operations for small and medium-sized companies after cheaper borrowing. It increases capex, such as buying new machinery, opening new branches, or hiring more staff, which increases productivity and creates more jobs, further strengthening the economy.

Lastly, the capital market behaves positively after a rate cut because it shows the RBI is supporting economic growth and providing liquidity. Nifty and Sensex moved higher after RBI announcement, specifically banking and real estate stocks gaining the most, as these sectors are directly influenced by interest rate movements. If inflation remains in check, the rate cut creates a ripple effect that can benefit various parts of the economy.

Conclusion

It is a bold and well-timed move by the country’s economic growth by the RBI to cut the repo rate by 50 basis points in June 2025. When inflation is under control and global economic conditions remain uncertain, it shows central bank’s strong focus on boosting domestic demand. RBI has made it cheaper for banks to borrow money, which in turn encourages them to lower interest rates on home loans, personal loans, and business loans by reducing the repo rate from 6.50% to 6.00%.

While this move brings several advantages, it also comes with some risks. Given the risk related to global oil prices becoming volatile or food prices rising due to weather-related issues, the RBI must carefully watch for any sign of rising inflation. Further, it could create financial stress later if too much cheap credit leads to high levels of household debt.

In summary, the RBI is committed to supporting economic growth through a rate cut. This step can strengthen the economy, boost investor and consumer confidence, and help India navigate global challenges, if it is managed wisely. In the future, the RBI will need to closely monitor how the economy reacts to this stimulus and be ready to make further adjustments if needed.