In the stock market buying the shares holding them in your demat account and waiting till they rise to make a profit is the common practice that investors do. And intraday traders also make long positions in stocks for the day or the next day to earn profits.

In both situations, traders generate profits when they will sell the stocks or square off their long position after selling the same stocks in the same quantity. This strategy works only when the market or individual stock is in an uptrend or bullish.

But what will you do when the market is in a downtrend or bearish, where stocks are falling more instead of rising? In such a scenario, short-selling is the right way to make money from the stock market. Let's find out what is short selling and how does it work.

What is Short Selling in Stock Market?

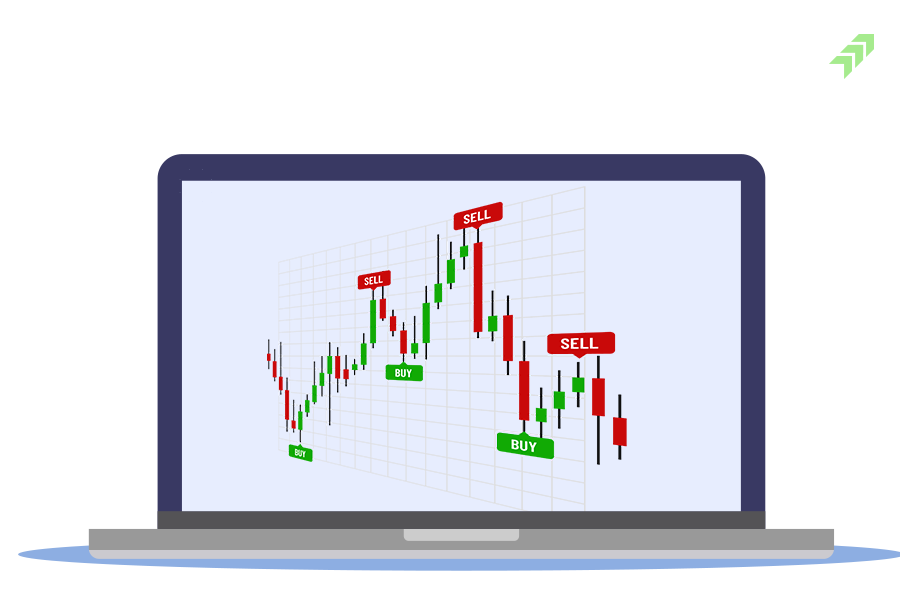

Short-selling which is also known as "shorting" or "going short", is a trading that is used when the market is falling. In short selling – an investor or trader sells shares that he doesn't own at the time of trade. A trader borrows shares from the owner of the shares after paying the brokerage and sells the same at market price with expectations that the price of shares will fall.

Also Read: How To Be A Good Investor Or Trader in 2023

And when the price drops, the short seller buys the same share in the same quantity again and books the profit he gained with the short-selling. Short-selling is a risky bet but can be profitable and that is without owing the shares into your demat account.

How Short Selling Works?

In short selling, the short seller usually sells the stocks that they don't have. To short sell, sellers borrow the stocks from the brokerage firms and then they sold the same at the current market price. And when the price of the stock goes down, to cover their open position, short-sellers buy the same shares in the same quantity and generate a profit.

However, if the price of the stock increases, even though short sellers have to buy the same stocks at a higher price, they incur a loss in short selling.

Whereas, in short, selling when the price of the stock rises, short sellers may wait for some time in the hope that the price will go down, as they have to repay the broker. Because when the price increase broker ask for the margin call, which is required while short selling to put more money with the brokerage account or close the position by buying the stock at a higher price.

Short Selling Example

To make the short-selling process more clear, let's take an example. Assume a trader expects the price of company XYZ's stock trading at Rs 200 per share to be overvalued and will decline. Here trader has to borrow 10 shares of XYZ company, from his broker and then sell the shares at the last trading price of Rs 200. If the price declined to Rs 125, the trader will buy back the 10 shares at this price and return the borrowed shares to the broker.

In the end, Rs 750 (Rs 2000 – Rs 1250) will be his profit. While on the other hand if the price of XYZ company rises to Rs 250, then investors have to bear the loss of around Rs 500, which is the most negative part of the short-selling in the stock market.

Short selling seems very straightforward, but this kind of speculative trading is very risky especially if you put a huge amount of money into short selling.

Why Short Selling is Good?

Generally, short selling is done to gain some profits in a downfall or bearish market trend. And short selling is good in terms of the following benefits.

To Make Profits: Short-selling is a highly speculative process, as traders make money even though, the underlying asset drops the price. When there is negative news or the company is in trouble, speculators take advantage of short selling and earn profits. Though, short sellers are responsible for causing or aggravating a decline to make more profits.

Hedge the Open Position: Apart from speculative trade to book profits, short selling is also done for hedging. Yes, this is the practice of holding two positions in stocks at the same time to counterbalance losses from one position with profit from another position.

In hedging traders with a short selling position can protect their long position from the losses. Suppose, if you think your held stock is going to decline, you can use the short derivative position to offset your risk. Though it is not necessary, that hedging prevents the loss, it can minimize the impact.

Why Short Selling is Bad?

While on the other hand, short selling has disadvantages too. As there is a huge chance of losses if the price of assets doesn't move as per your expectations. In short-selling the potential loss is unlimited while the potential profits are limited. Short-selling is fundamentally a pessimistic move that works only in a bearish market trend where stocks mostly fall.

In buying the stock, the potential loss is capped at 100% of the total amount originally invested and potential profits are unlimited. While in short-selling, the maximum profit is capped at 100% of the originally invested amount and losses are unlimited. Hence, short selling is bad and can be risky if the stock bounces back swiftly at a very high price.

Why Short Selling is More Profitable?

Who says short-selling is more profitable? I've already told you when make long position is a stock the potential profits are unlimited. When you short-sell, the maximum profit is limited to 100% but the loss can be unlimited if the stock keeps rising.

Short-selling can be more profitable when working intraday. When short-sell any stock and as per your expectation it goes down, it can give you lucrative returns. And there is a bearish market trend, mostly stock does not move upwards, instead, they fall when the market is down. In such bearish market sentiments creating a short position can be more profitable.

Also Read: What is Intraday Trading: Is it Profitable, How to Learn& Earn Money

Nevertheless, short selling is not always profitable, especially when the market is bullish. In a bullish market, stock-specific news or company-related negative news can be the short-term factor that can affect the price of the stock. Such stocks can be short-sell.

Otherwise fundamentally, undervalued stocks in upward market conditions are not good for short-selling. And there are a few things you should consider while short-selling that can help you to play cautiously and gain maximum profits from such trading.

5 Things to Know Before Short Selling

- Short-selling is the idea of selling the equity shares that are actually not held by a seller and are not possessed or available in sellers demat account.

2.All types of Institutional as well as Retail investors are legally permitted to short sell, until and unless they do not use any illegal practice to manipulate the price of stocks through huge or continuous short selling.

3.In short-selling the shares are borrowed by the seller from the broker with the promise to be delivered back to the broker at the time of settlement.

4.Short-selling works and can happen when there is a bearish market trend in the market and investors expect the price of a share is going to fall.

5.After short selling if the price of the stock goes down he can buy back at a lower price and generate a profit. While on the hand, if the price of the stock rises, the short-seller has to buy back at the higher price and he will incur the loss in short-selling.

How to Find Short-Selling Stocks?

Merely picking any stock and short selling will not give you a guarantee for a profitable trade. Even in the bearish market conditions you need to be very careful while selecting the stocks, as selecting the right stock for short-selling could be a game changer.

Also Read:What is Breakout & Breakdown How to Identify Breakout in Stocks?

For short-selling you can pick the stocks as per the market conditions. Basically, in a bearish market, the highly volatile stocks or shares having a high beta – means they react more than the main indices when the market moves upward or downwards.

While in normal market conditions or the market is range bound, you can select the stocks for short sell that are fundamentally weak. Or you can also pick any stock in which any negative news is likely to come or financial results are not declared as per the expectations. In the short-term, they can give you a good amount of profit due to such negative sentiments.

However, if the market condition is very strong or bullish you should never short any fundamentally strong stock. As shares of companies with strong fundamentals and good financial performance should be avoided for short selling.

Apart from fundamental parameters, there are various technical analysis tools and techniques you should use to check whether it is undervalued or overvalued and trading into the overbought zone or an oversold zone. Technical indicators help to find out the trend and potential of the stock where it going to move and how much return it can give if used for short selling.

Also Read: Technical Indicators that Every Trader should be aware of

Summing-up

Short-selling is not meant for beginners or inexperienced traders in the market. As there is a huge risk in short-selling, especially if you are not aware of the various aspects that affect the price of the stock. Short-sealing is a pessimistic move, and works mostly in a bearish market, hence you should avoid it, especially when the market is in a bullish trend.

In a nutshell, if you looking to earn profits from short-selling either you are an expert trader or you should take help from the market experts like technical analysts, who understand the market moves better and can suggest the right stocks as per the market conditions. These analysts working with broking firms use the most advanced tools and techniques to screen stocks that are suitable for short-selling and recommend the same to their clients.

Moneysukh is one the leading broker in India, offering a wide range of trading and investment solution in equity, commodity and currency markets. Apart from algo-based trading, it is also providing the most dynamic online trading platform backed with cutting-edge technology and advanced trading software that is highly secured and accessible on various devices.

Also Read:What is Algo Trading How it Works and is it Profitable

If you are looking to make money from short-selling, you can apply for trading and also open a demat account at Moneysukh and enjoy the stock buying and selling tips on your mobile with quick alerts to book profits or exit from the stock. Here you can enjoy unlimited trading in equity, commodity or currency at the lowest brokerage with the highest margins.

No comment yet, add your voice below!