Professional traders often hunt for patterns by manually drawing trend lines or forming patterns and identifying key support levels where a reversal could occur. However, spotting these formations in over 1000 of the listed stocks is not as easy as it sounds. But this task can be made easy with the help of Moneysukh Traderadar.

Traderadar is a platform offered by Moneysukh that helps investors navigate the stock market by generating buy or sell signals based on complex mathematical algorithms or manual inputs. It removes noise and helps identify stocks that fit investors’ needs and goals. Moneysukh Trade Radar provides detailed insights by analyzing large amounts of data across multiple exchanges under one dashboard. This new generation of algorithmic cloud-based tools offers a unique decision-making edge in markets and is accessible from anywhere to all Moneysukh clients free of charge. The platform offers complete market insights, including stock movements, new long shorts, and machine-generated option strategies for all market conditions. Trade Radar offers the best software tools available, ranging from simple real-time scanners to complex strategy building, mining massive amounts of data, and assisting investors in making informed decisions.

Also read: Traderadar : Perfect tool for Intraday Trading

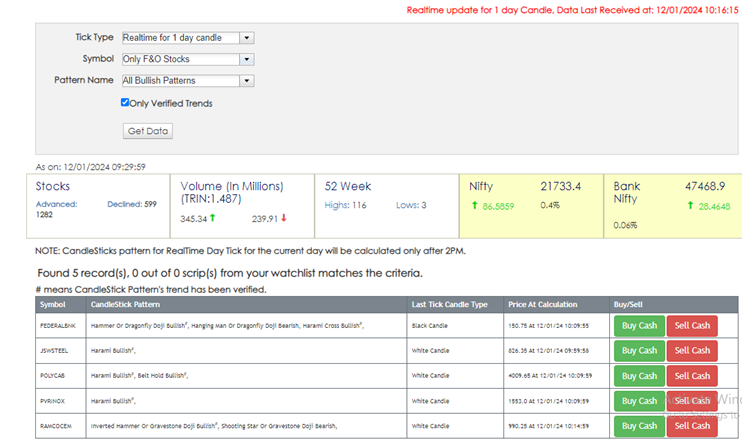

In this article, we will be discussing bullish candlestick stock patterns that were identified by Traderadar. This article will also let you know the application and insights that Traderadar could generate. Some of the bullish patterns that were formed on the daily chart are as follows:

- FEDERALBNK: According to the Traderadar candlestick stock screener, the Hammer or Dragonfly Doji Bullish, Hanging Man or Dragonfly Doji Bearish, and Harami Cross Bullish patterns are forming on the chart. After the short listing has been done through the platform, we first drew a trendline on the chart, which we saw. The Federal Bank chart has been trading in a channel since late May 2023 and recently formed a descending triangle pattern. The stock can take strong support at the Rs. 148–Rs. 150 level.

Also read: How to Read, Analyse & Use Candlestick Chart Patterns for Trading?

- JSWSTEEL– Nifty Metal Index has underperformed the previous year because of a high interest rate and a slowdown in the global economy. JSW steel stock has been trading in an upward channel for the past year. The stock rejected its head and shoulder pattern in March last year, and recently the stock has been rising because of strong domestic growth and expectations of a cutting interest rate internationally. The stock that began its bull run in November has retraced 50% as per the Elliott wave. The stock formed a hammer pattern on January 10, and the RSI indicator was also significantly corrected.

Also read: What is RSI in Trading & How RSI Works? Formula and Strategy

- PVRINOX: – According to the Traderadar calculation, the stock has formed an inverted hammer or gravestone doji bullish and a shooting gravestone doji bearish on the daily time frame chart. The stock has been stuck in an upward channel since May 2020. The stock, viewed in a shorter time frame, is following a downward channel, has taken support at Rs. 1520, and has formed a harami bullish pattern.

- POLYCAB: The stock has fallen by more than 25% in the past five sessions after news came in the media that the group was raided by the Income Tax Department. The stock has taken support from the rising trendline as shown in the chart and formed the Harami Bullish and Belt Hold Bullish patterns. The stock made a gap-down opening in the previous session. Further, any stock movement will purely be news-based.

No comment yet, add your voice below!