In TradingView you can find an unlimited number of tools and indicators that you can use for technical analysis. From originally developed technical indicators to customized community-based useful indicators, you can pick the best tool that suits your trading strategy. All types of indicators have their own applications and utility as per market conditions.

Supertrend Indicator is one of them that you can use in your intraday as well as short-term trading strategy. However, there are already various indicators you can add in TradingView like RSI,MACD, Fibonacci Retracement,Volume Indicators etc. you can use to analyse the market or stock trend to enter into trade. But as the name suggests a Supertrend indicator can be very useful and best of all you can use it individually or in combination with others.

Also Read: How to Add, Read Use Best Volume Indicator in TradingView

Yes, today we are going to talk about this Supertrend indicator that comes with unlimited features in TradingView. It is a trend-following indicator based on the Average True Range that you can use to identify changes in trend direction and to position stops. So, let’s talk about this super indicator in more detail and how you can use this in TradingView for trading.

What is Supertrend Indicator?

The Supertrend is a trend-following indicator that overlaps on the main chart structure in TradingView like candlestick chart patterns and the plots created by this Supertrend indicator show the current trend in the stock price or market index movement.

Also Read: How to Find Trending Stocks for Intraday Trading: Ten Rules

You can also use the Supertrend indicator with different time periods like intraday, daily or weekly etc. and on the different types of underlying assets. You can apply this for different ranges from the last three hours to the previous three months.

Also Read: How to Do Intraday Trading: Best Stocks, Charts & Strategies

The Supertrend indicator combines many periods, into one that helps to know whether the trend likely to continue further or not. And when two or more time frames overlap, it indicates that the trend is likely to further continue in future. However, the calculation of a single line in the Supertrend indicator combines trend detection and volatility.

How to Add Supertrend indicator in TradingView?

Adding the Supertrend indicator in TradingView is very simple a few steps away you can add this to the TradingView chart. From the indicator section in TradingView, you can apply the Supertrend. For the stepwise guidance follow the steps given below.

Steps to Add Supertrend Indicator in TradingView:

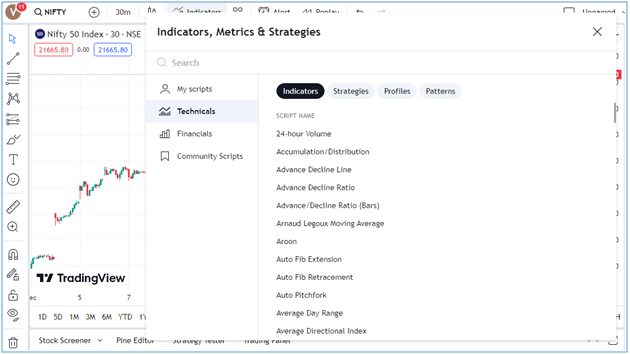

Step 1: First of all hover your mouse on the “Indicator Menu” to highlight this section.

Step 2: Now click on this menu to open the list of all the indicators and other metrics.

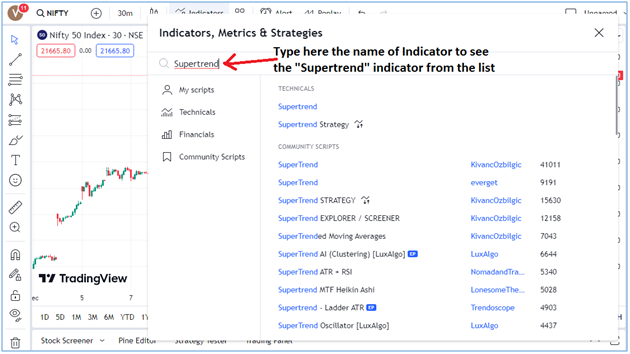

Step 3:Type here the name of the indicator “Supertrend” to see the list of all similar name indicators.

Step 4: You can see the list of all the similar name indicators, just select the “Supertrend”.

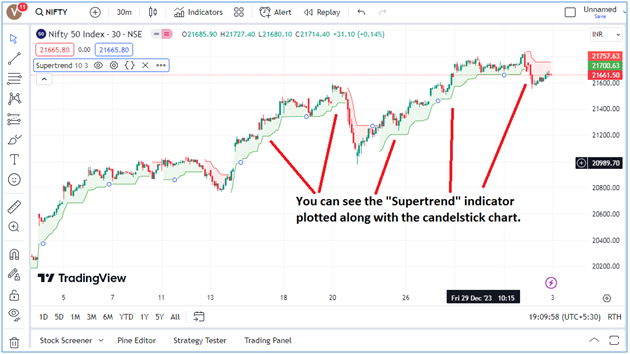

Step 5: When you select “Supertrend” you can see it is plotted along with a candlestick chart.

Once the “Supertrend” indicator is plotted with default settings on the chart, you can see a line is drawn along with the candlestick chart. You can see the green line is showing when the market is in an uptrend and the red line is when the market is in a downtrend. However, you can change or adjust the Supertrend indicator settings as per your trading strategy.

What is the Best Setting for a Supertrend Indicator?

However, the Supertrend has various inputs that you adjust as per your trading strategy. And when you adjust these settings the Supertrend indicator becomes more sensitive to price changes. Though the ideal settings for the Supertrend indicator are 10 and 3 for periods and multiplier, respectively, for the Supertrend inputs, you can adjust atrLength and multiplier as per the recommended settings given below.

Best Setting for Supertrend Indicator in TradingView:

- The atrLength setting is the lookback length for the ATR calculation;

- Multiplier is the ATR that is multiplied by to offset the bands from price.

You can adjust or change the settings in the Supertrend but keep in mind when you do that, the indicator will respond more to price changes with smaller settings that can give more signals. While higher settings, will reduce the market noise but can give you only limited trade signals.

Also Read: How to Set Up, Adjust, Save, Clear, Reset TradingView Chart Settings

Best Settings for Supertrend Indicator for Intraday Trading

For intraday trading, you can use the 1-minute scalping or you can also use the 5-minute chart as another useful timeframe to consider while adjusting the Supertrend indicator settings for intraday trading. However, for the best supertrend settings for day trading, you can keep the values of (10,3). To avoid getting ant false signal you can use the combination of Supertrend with other indicators like Bollinger Band or Moving Averages to confirm the trend.

Also Read: How To Use Best Moving Averages for Intraday or Day Trading

Best Supertrend Settings for Positional Trading

For positional trading, you can use the Supertrend indicator with a longer time frame that will help you perceive the right trade signals and outperform the short-term volatility in the stock price movement you are looking to create the long-term position.

Though, the best Supertrend settings for positional trading you can use the 1-day and 4-hour chart along with the default parameter of 10, 3 in ATR length and Factor. For longer periods you can also set 30, 9 parameters for the positional trading. Though the parameters and settings for the Supertrend can be different as per the trading strategy using the Supertrend indicator with the right interpretation is more important to get the right signal for trade.

How to Use Supertrend Indicator in TradingView?

You can not only use the Supertrend indicator to know the trend in the price movement, but you can also use it to get the signal for creating the long or short positions in the underlying assets. As per the expert’s view, when the price goes below the indicator curve, the line becomes red and indicates there I downtrend running in the underlying asset.

While, on the other hand, when the price goes above the curve, the indicator becomes green, giving the signal of uptrend. However, after every closing below or above the Supertrend, a new trend is visible in the price movement of an underlying stock or market index.

And based on these changes in the Supertrend line you can create the long or short positions. When the Supertrend line goes below the closing price and turns green a buy signal is generated, conversably when the Supertrend line closes above the closing price and becomes red, you can go for short-selling or create the sell position in the stock for trading.

How to Use Supertrend Indicators for Swing Trading?

Apart from intraday trading or positional trading, many traders use this Supertrend for swing trading.While using the Supertrend for swing trading you need to consider two things in your mind: period length and multiplier values.

Also Read: 7 Biggest Mistakes To Avoid While Doing Intraday Trading

The period length you choose, defines the number of bars used in calculating the indicator’s value, while the multiplier value adjusts how it is sensitive towards the change in price. Though Swing trading suggests long-term strategies, thus your timeframe will reflect this in the price movement.

Also Read: Swing Trading Strategies Indicators & Best Stocks

As per the market experts, the best Supertrend settings for swing trading are usually the 4-hour and 1-day charts that you can use in combination with the default 10,3 Supertrend line. However, you can follow another trading strategy of using the swing trading with the Supertrend Indicator in conjunction with a moving average that will help you to confirm the trends and also provide additional signals to enter or exit the trade positions.

Supertrend Strategy TradingView

To make your trade more profitable with the right strategy, you need to follow the Supertrend strategy in Trading that is based on the Supertrend indicator.The simple Supertrend strategy you can follow is that enter into the long position when the Supertrend changes its position from being above the chart to being below the chart.

While entering into the short position you can observe the Supertrend change its position from being below the chart to moving above the chart. However, there are 3 Supertrend strategy TradingView that can work lower time frame trades likeintradayand scalping.

3 Supertrend Strategy TradingView

The Supertrend strategy in Trading provides various trading options for the intraday as well as for the positional-based traders. The 3 Supertrend indicators can be for direction confirmation for entries. When the price is moving above the Supertrend it means there is a bullish trend, while when the price is trading below the Supertrend, it indicates abearishmovement.

Also Read: Best Option Strategy for Bearish Market: 7 Option Strategies

However, sometimes, it would be not enough to enter or exit from the trade positions. Hence, here you can use the combination of 3 with slightly increasing the longer periods and increased ATR multipliers that will give you better confirmation of the trend.

As a part of the Supertrend strategy in TradingView, you should enter into the position when 2 out of 3 Supertrends are in your favour. And if all the 3 are on your side it would be the best situation. While the second farthest Supertrend from the entry price is used as a Stop Loss.

Though remaining the Supertrend on your side is not a requirement to enter into a trade position, instead the probability of success becomes higher with Supertrend and a longer EMA on your side, but here you need to make sure that don’t get late or enter after price movement already taken place.

In such cases, you can use the Stoch RSI to choose the right entry point where the price is oversold/overbought and reversing.This means the Stoch RSI is above 80, or below 20, but the right indication to enter into trade is when the 2 lines cross reversing direction.

Also Read: How to Add & Use RSI Indicator in TradingView: RSI Settings & Strategy

If the trend direction is on your side, you have opportunities to enter these oversold/overbought zones, especially when there is a reversal or Stoch RSI K and D are crossing. You can also use the Supertrend as a support/stop loss but while entering into the trade the price should be above it.

The Rules for Triple Supertrend Strategy:

As per the 3 Supertrend strategy, you need to consider the 200 EMA and Stoch RSI. As per the rules, you can enter into a long position only when the price above EMA200 and Stoch RSI is below 20, cross up and at least 2 Supertrend lines below close.

While for entering into a short position only, when the price is below EMA200, Stoch RSI is above 80, cross down and at least 2 Supertrend lines above close.

And while following the strategy you should set stop loss to one of the Supertrend lines and Multiply by 1.5 for profit. This means targeting target 1.5x your maximum loss so that even if we only win 50% of the time, you will still make a profit.

Is the Supertrend Indicator Reliable?

The reliability of a Supertrend Indicator depends on the various factors that affect the stock market the sentiment of the investors, their investment goal, risk-bearing capability, time horizon, and the type of underlying asset you are choosing to trade.

Also Read: Types of Risks Associated with Investing in the Stock Market

However, it can be a reliable tool in a trending market or stock moving in a particular trend but can give you a false signal when the market is consolidating or moving in a sideways range. Hence, you can use it as a part of a comprehensive strategy.

Hence, the best way to ensure the reliability of the Supertrend indicator or any other indicator is to use them with a combination of other top best and most used indicators in TradingView. Just like Supertrend, other indicators will help you to confirm the trend and also indicate the best points to enter into trade or exit from the trade position profitability.

Also Read: What is Profit Booking in Stock Market: Rules & Best Strategy

Final Words

Supertrend indicator no doubt as the name depicts, is one of the super best indicators in TradingView that you can use in technical analysis. You can use the Supertrend indicator to know the trend in the stock price or market index and enter into trade with different time frames for intraday trading, short-term trading, swing trading or long-term investments.

Also Read: Is Technical Analysis Useful or Useless or Enough for Trading

Supertrend usually generates buy and sell signals based on the direction of trends and adjust itself to market volatility if used with the ATR. The indicator plots a line (green for uptrend and red for downtrend) on the price chart, aiding as a crucial support or resistance level, thatadjusts its points relative to the price when the trend changes.

In the TradingView chart set-up, you can add this indicator from the indicator section and can also customize the settings per your trading strategy. To make the best use of this indicator follow the triple Supertrend strategy TradingView with the right rules as per this strategy and create the long or short positions accordingly to get the best results.

To make the best use of such indicators, you need a right platform that can offer you not only trading facilities but also provide you the real-time market data with live feeds and all the resources to perform fundamental and technical analysis foranalyzingthe market conditionsand take right decisions tobuy or sell stocks or do option trading in F&O with the help of market experts. Moneysukh is right here to help you with all such resources and trading tips.

Also Read: Technical Analysis vs Fundamental Analysis: Which is Better

Being one of the oldest stock broking houses, Moneysukh is also one ofthe best discount brokers in India providing the best trading platform for trading and investing in the stock market, commodities and forex markets. It offers an online trading facility with the best trading app to trade from your computer or smartphone atthe lowest brokerage charge.

Also Read: What to Know Before Investing in Stocks: 10 Things to Consider

You can open here demat and trading account to trade or invest in the secondary market or apply in IPOs with the facility to enjoy high-frequency trading at the best pricing. Apart from the manual trading system, you can also start algo trading in Moneysukh which offers the best algo trading platform with the best intraday algo trading strategy to experience the power of best-in-class automatic trading with cutting-edge technology at the lowest charges.

Also Read: What is Algo Trading How it Works and is it Profitable

You can open a demat account online here and also utilize the resources like trading with the world’s most advanced software and algorithms such as Trade Radar, TradeTron, Quantman, AlgoBulls,Keev and FoxTrader backed with TradingView, a most advanced charting system. Here you will also get tips and recommendations from the market experts to select stocks for intraday trading or invest in the shares with the long-term capital gain from the market.

Also Read: Benefits of Investing in the Stock Market: Advantages of Share Market